Will Digital Currencies become the Next (Broadly Accepted) Currencies?

As digital currencies make headlines in Davos, Juergen Braunstein, Marion Laboure and Clara Voluntiru explore their possible futures.

The speed in recent cryptocurrency developments left many observers worrying. One of the most controversial issues was the question of bubble or not bubble. This surfaced in the context of the swift emergence of cryptocurrencies. Another question is : how new this boom really is? Is the recent Bitcoin boom something unprecedented, or is it just a digital repetition of the Tulip Mania of the 17th century? That was a brief period in which large amounts of capital were flowing into the fashionable tulip trade - contract prices for some tulips reached astronomic prices and then collapsed dramatically at the beginning of 1637.

From venture capitalists to lottery players, from Wall Street to Silicon Valley people are prone to taking chances. As uncertainty becomes the new normal this changes our risk perceptions, which in turn can increase our risk tolerance. Without necessarily focusing on current facts, dozens of blogs and papers have over the past year described a “bubble”, “craze”, “mania” or “herd behaviour” with respect to Bitcoin.

Fact is that we are in the early stage of Bitcoin adoption. This is taking place not only in a rapidly digitalising society but also in a post financial crisis environment (i.e. the 2008 financial crisis has shaken the trust in the conventional financial system) and with central banks around the world adopting quantitative easing – printing money.

Though the number is still small, more and more shops accept Bitcoins as a payment method. Especially online booking platforms and travel specialists, such as Expedia and Virgin airlines, and retailers, such as US video game retailer Zynga, accept Bitcoins. A few Subway branches as well as Remax real estate – a UK based franchise of the global real estate network approve Bitcoins as a payment device. Despite rumours major online retailers such as Amazon and Ebay do not accept Bitcoins at this stage.

But what could this mean for the future and how critical are tech companies, which are now involved in the creation of money outside the conventional financial system? What are the prospects for greater regulation and institutionalisation?

Earlier experience with financial innovations offers surprisingly current lessons about the next stages of Bitcoins adoption

Gold to paper money – From the 17th century onwards, paper money became a widely used, practical payment device, especially in a rapidly urbanising environment which is characterised by increasing trade. This transition took place during the context of the “price revolution” where large amounts of gold and silver were entering Europe through Spain, which started exploiting massive gold and silver deposits in Latin America.

Banks began to hand out the receipts as payable to the bearer of the document. Up to the first half of the 19th century, many towns in the United Kingdom had their own local banks, each of which issued its own banknotes. Before the emergence of national currencies and efficient clearing houses, banknotes were only redeemable at face value at the issuing bank. Similarly, you can only make purchases in a Bitcoin shop with Bitcoins and not with other cryptocurrencies, such as Litecoins.

Likewise, today there is no monopoly in cryptocurrency creation. To date there are more than 1,300 different cryptocurrencies out of which Bitcoin has the highest market cap, followed by Ethereum. Everyone with coding knowledge and a wide social network could create their own currency.

Paper money to plastic – In the 1960s, with the start of global travel, companies that were not originally finance companies started issuing traveller cheques and issuing credit cards. For example, American Express originally an express delivery company, introduced in 1959 its credit card, which was followed soon by Frank McNamara who created the Diner’s Club card. Initially these cards were used for entertainment and travel expenses. For example, in 1959, Diners Club had around 10,000 members from New York city’s business elite and 28 restaurants and two hotels accepting the credit card. The demand towards credit cards started increasing significantly after the Internal Revenue Service – the US tax agency – began to require detailed records of business expenses. The regulation of credit cards only started from 1970 onwards.

Three major challenges preventing Bitcoins from becoming the next (broadly accepted) currency

Though still at its early adoption stage, the Bitcoin is on the rise and has many benefits, such as security, speed, minimal transaction fees, unit of account and money of exchange, its ease of storage and management and its relevance in the digital era. However, several challenges of primary importance remain for Bitcoins to become the next broadly accepted currency.

The first and greatest challenge would be to face the government monopoly. If Bitcoins were to become a broadly accepted currency, it would remove the monopoly from governments. Governments will likely want to keep their currency monopolies and will probably interfere. And governments have already started regulating cryptocurrencies around the globe, both in developed and emerging economies. In the United States, the Internal Revenue Service issues decisions on how Bitcoin earnings should be taxed and Bitcoin wallets must now comply with anti-money laundering rules.

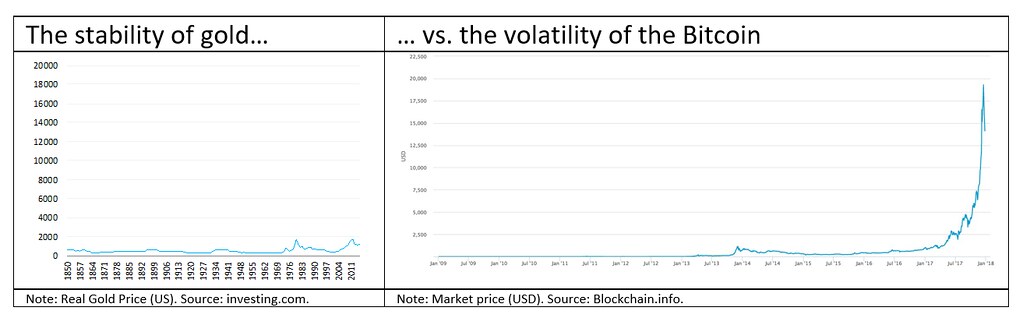

Supposing that governments do not interfere; two other problems remain. The next issue deals with the stability of a currency. While real gold price (in U.S. dollars) was relatively stable over the period 1850-1970, Bitcoins have already strongly fluctuated over the past few years and especially over the past few weeks. Per Blockchain.info, the average USD market price across major Bitcoin exchanges fluctuated between a high peak of $19,499 in December 2017 to a record low of $177 in January 2015. This makes it hard for the Bitcoins to satisfy the function of a stable store of value.

The second major challenge is that a currency is also a unit of account for debt. With large price fluctuations, it makes it hard to think about financing your house with a Bitcoin mortgage. In 2017, it would mean that your debt would have risen tenfold. However, as your salary is paid in dollars, euros or another currency, it would not have grown as rapidly. As a result, had Bitcoin been widely used, the last year might have been massively deflationary.

The third criticism is related to energy consumption. The electrical energy required for the ‘mining’ or production of bitcoins (or cryptocurrencies in general) is currently increasing proportionally with their market valuation. As such, numerous alarms have been raised with respect to the environmental impact of this huge energy consumption. In a previous article we underlined the opportunity for bitcoin adoption in low financial inclusion and high mobile penetration markets. Also countries with low cost electricity & fast internet connections, such as Armenia, offer opportunities for Bitcoin mining. It is also very likely that the vast resources currently engaged in the cryptocurrency market will be able to make a significant push for greener technological advancements; positive externalities: technological innovation in the financial sector driving innovation in the energy sector.

The fourth and last issue remains privacy. Part of the success of the Bitcoin is explained by privacy. For several years, people believed Bitcoins could make anonymous transactions that administrations could not recognize. Nevertheless, the blockchain keeps track of a considerable number of transactions. Although they are pseudonymous, the government can make use of other information to reconcile the transaction and obtain identities. And it is likely that governments have already made use of this. After all, governments are unlikely to endure anonymous financial transactions protecting terrorists and criminals. This last issue is probably the least important, given that there are many ways for governments to overcome anonymity.

Cryptocurrencies such as Bitcoin are for now additions rather than substitutes to the global inventory of money. They allow the settlement of transactions and the storage of value. Cryptocurrencies are instances of financial evolution. Every period has its evolutions, and thus it is not surprising that Bitcoin has emerged in the digital age.

Juergen Braunstein, Harvard Kennedy School. Marion Laboure, Harvard University. Clara Voluntiru, Bucharest Academy of Economic Studies.

Image credit: Francis Storr via Flickr (CC BY-SA 2.0)