Rethinking premium support for climate protection

Veronika Bertram introduces the findings of a paper exploring the complexities of international insurance premium support for improving societies’ financial resilience to climate and natural hazards.

In recent years, donors have increasingly subsidised premiums for vulnerable countries as they seek to scale up financial protection against climate-related shocks through sovereign insurance solutions. Compared to other forms of support, such as capital and technical support, premium support directly reduces the price of insurance and has the potential to provide a more direct route to financial protection. However, the current approach to premium support has yet to deliver sustainable impact.

Insurance is widely recognised as a tool for improving societies’ financial resilience to climate and natural hazards. As a pre-arranged financial mechanism, it can enable countries to better plan and prepare for disasters, and work to increase the predictability, speed and effectiveness of responses to shocks. Yet, despite significant investments by development partners since the mid-2000s, affordability remains a significant barrier. Premium support seeks to address this.

Our new insight paper explores the complexities of international premium support and identifies core challenges with current approaches to the allocation and design of premium subsidies. It underscores the pressing need for reform. Drawing on insights from over 60 experts in international and national organisations engaged directly in providing or receiving premium support, our research reveals that despite internationally agreed principles to guide these processes, decision-making remains dominated by global actors, which too often leads to premium support that doesn’t take into account recipient countries’ specific needs and realities. A lack of transparency and communication between donors, implementers, and recipients has served to hinder the ability to evaluate and adapt subsidies effectively and align them to the bigger picture of international crisis financing.

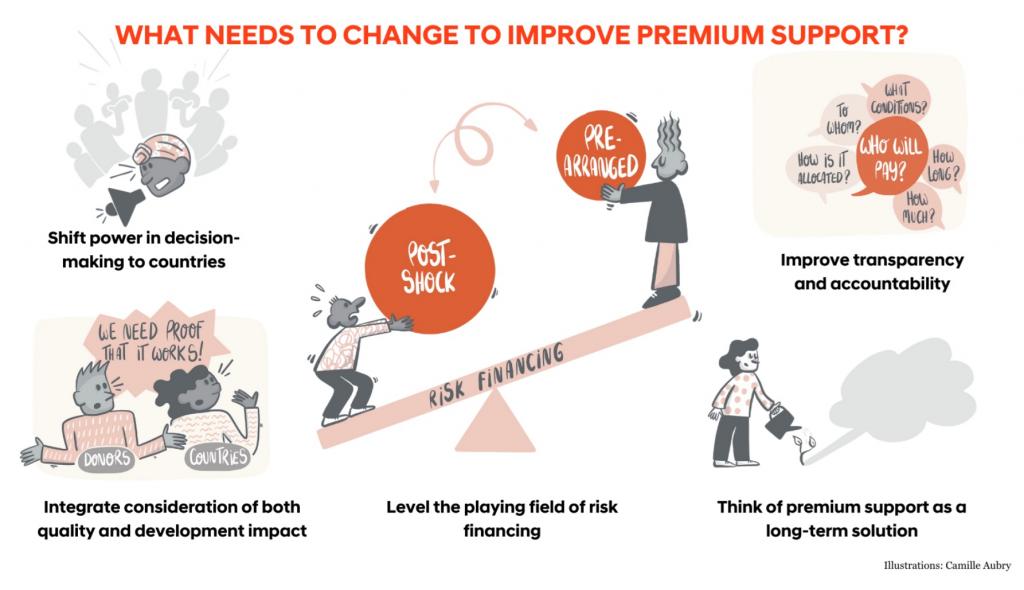

The paper calls for a fundamental shift in how premium support is approached. It sets out the need to move from a top-down model to one that puts vulnerable countries at the centre – better integrating the countries’ perspectives , priorities and contexts into decision-making around allocation rules and subsidy offer. This includes consideration of premium subsidies as a long-term solution that reflects countries’ development paths, as well as seeking to level the playing field of crisis financing instruments for countries. Importantly, this shift must be accompanied by a commitment to greater transparency – clear information on subsidy objectives, terms and conditions – and a focus on quality and impact of subsidised products and delivery channels. Taking these steps would help create a more inclusive, sustainable and impactful approach to subsidising insurance for climate risks.

Reforming premium support is critical in the context of the emerging climate risk finance landscape, including the Global Shield, launched by the Vulnerable 20 Group (V20) and the Group of Seven (G7), which positions itself as a provider of subsidies and as a key part of the mosaic of financing approaches designed to respond to climate-induced loss and damage needs.

Now is the time to rethink international premium support: designing with coherence, value for money, and development impact in mind.

To deliver on its ambition, international premium support needs to be rethought with much greater reflection on the broader context of crisis financing, the opportunities for vulnerable country engagement, and on the need for greater transparency and accountability to ensure quality and impact. Meeting the needs and priorities of vulnerable countries should be front and centre of all future approaches to premium support.

Veronika Bertram is Lead Risk Finance Adviser at the Centre for Disaster Protection and is passionate about financial solutions and systems that create protection against climate risks.

Photo by Rachel Claire