Why Investors Can't Afford to Ignore China's Central Bank

When Zhou Xiaochuan hands over the reins of the People’s Bank of China after 15 years in control, his successor will take charge of a central bank with unprecedented global influence.

The economy’s size has ballooned from $1.5 trillion in 2002 when he started -- back when Alan Greenspan was leading the Federal Reserve -- to about $12 trillion today. China is estimated to have contributed more than a third of global growth last year, according to the International Monetary Fund. The nation surpassed the U.S. as the world’s biggest oil importer last year, buying about 8.43 million barrels a day. It’s also the world’s biggest trading nation with total trade of $3.82 trillion in 2016, ahead of $3.58 trillion for the U.S.

Other central banks are scrambling to deepen links and decipher PBOC policies. Reserve managers including the Bundesbank are buying yuan, Thailand has joined countries extending a currency swap arrangement while the Bank of Indonesia is opening a representative office in Beijing this year -- the ninth central bank to establish an office in China.

A shake up to the financial oversight system means the PBOC will soon be able to stand on the global stage buttressed by an enhanced role at home too. That means even if its direct financial linkages are still tiny when compared with the Fed, decisions taken by the bank will become increasingly crucial.

"It is becoming much more influential," said Helen Qiao, chief greater China economist at Bank of America Merrill Lynch in Hong Kong. "Whoever has important influence over the biggest contributor to global growth will be seen as having a much more important role in central banking globally."

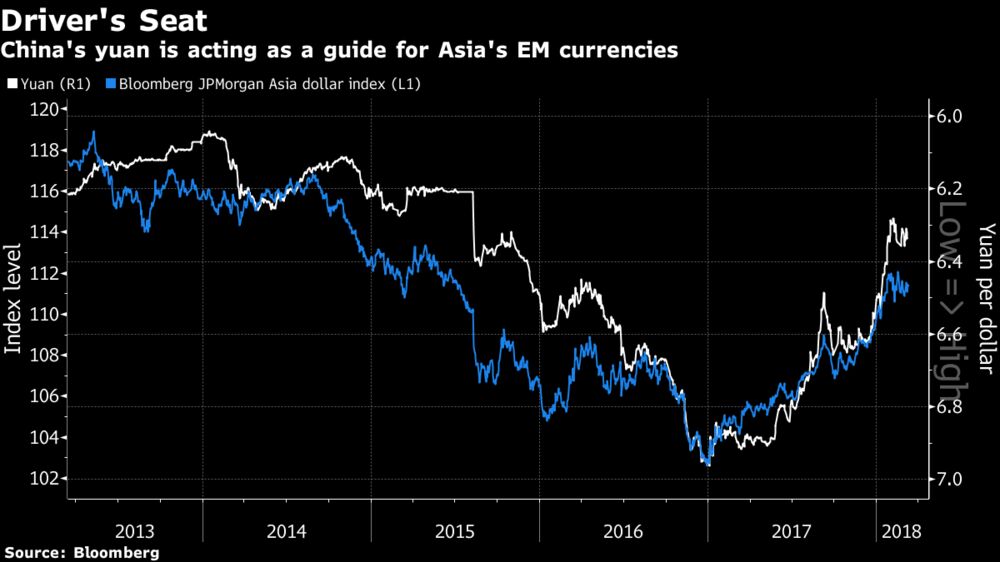

An illustration of just how much the PBOC’s clout has grown came in August 2015 when an attempt to re-jig how China’s tightly controlled currency is traded sent tremors through world markets. It was even among the reasons cited by the Fed when they delayed a widely anticipated interest rate hike the following month. Subsequent tweaks to the yuan’s trading mechanism have also caused ripples given the currency’s role as an anchor for the region.

Gregory Chin, a Professor at York University in Toronto, said central banks and finance ministries across the world now parse the PBOC’s statements and track changes in its monetary policy, inflation, the yuan, reserves and interest rates.

"Central banks in Asia, and in Europe, the Americas, and Africa, are working to strengthen their understanding of how the PBOC shapes policy decisions," said Chin.

When the PBOC alters interest rates or liquidity, it impacts trading partners and especially commodity prices, commodity exporters, commodity currencies and big exporters of industrial equipment, according to Wang Tao, head of China economic research at UBS Group AG in Hong Kong. "The influence is mainly through real economy channels," Wang said.

World's Biggest Exporter - China sells more goods globally than the U.S.

International Monetary Fund

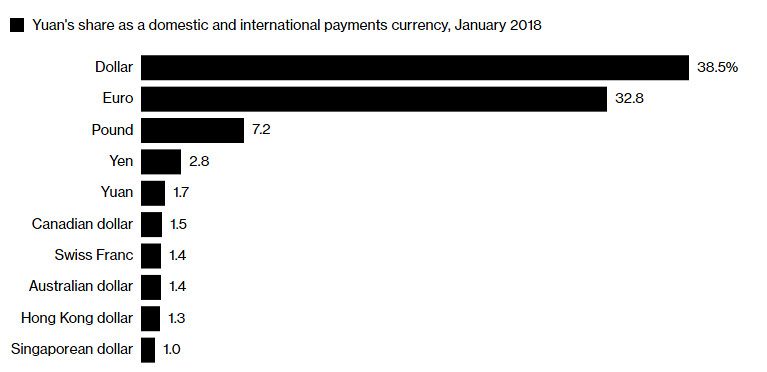

The PBOC’s influence through financial channels has failed to keep pace with its real world heft. The dollar remains the global reserve currency and attempts to internationalize the yuan have stuttered, in part hampered by strict rules on moving currency in and out of the country.

Dollar Rules - U.S. currency dominates global payments

Swift

A lack of independence and the opaque manner in which decisions are made -- the State Council dictates policy -- have also limited the PBOC governor’s influence.

While it’s unlikely that the PBOC will become formally independent any time soon, the institution is being handed high profile tasks. The central bank is playing a key role in President Xi Jinping’s signature campaign to cut dependence on debt for growth, and is emerging as first among equals as the nation’s regulatory system is overhauled, acting as the lynch-pin for efforts to coordinate banking, insurance and securities oversight.

A lot will depend on the rank and prestige embodied in the choice of successor for Zhou, with Xi’s pick for that post as yet unannounced but set for confirmation by the National People’s Congress in the coming days. A high profile governor -- such as Politburo member Liu He -- would suggest a prominent PBOC role in the overall power matrix.

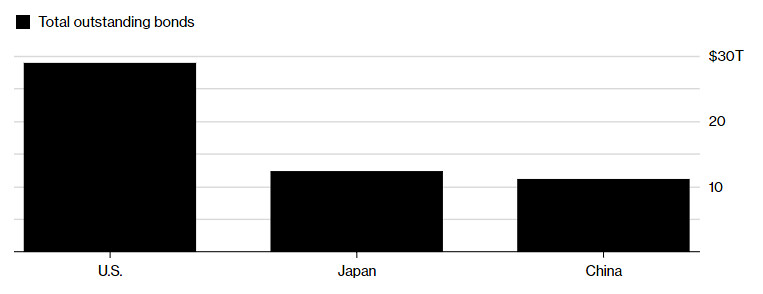

Whoever that is, the institution has become too big to ignore. The PBOC shepherds the $3 trillion pile of international reserves, the world’s biggest, making it a player in global debt and currency markets. It has set up currency swap lines with dozens of countries to grease trade and, if needed, to act as an emergency backstop -- creating the kind of tools once dominated by Western central banks. And its bond market is growing fast, luring foreign capital that will deepen financial links.

Sprouting Up - China's bond market is already the world's third largest

Source: Bloomberg

NOTE: Bonds include government, muni, and corporate securities

That means the PBOC’s role is headed in one direction, said Cui Li, head of macro research at CCB International Holdings Ltd. in Hong Kong.

"There is no doubt that PBOC’s global influence is rising," she said.

— With assistance by Lianting Tu, and Garfield Clinton Reynolds

This article first appeared in Bloomberg.com and is published by special arrangement.

Image credit: bfishadow via Flickr (CC BY 2.0)